公司简介 ABOUT US

——————————————

安博(中国)

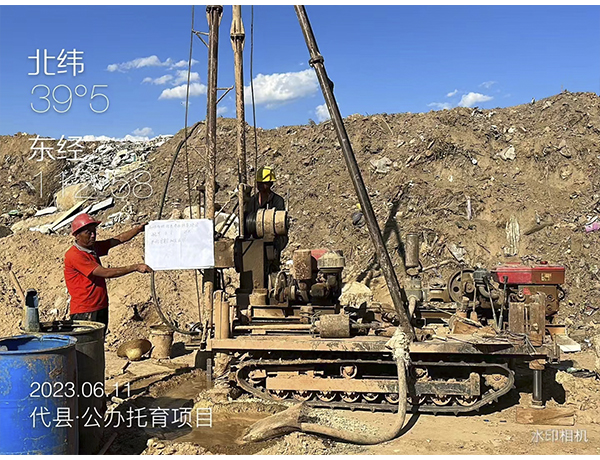

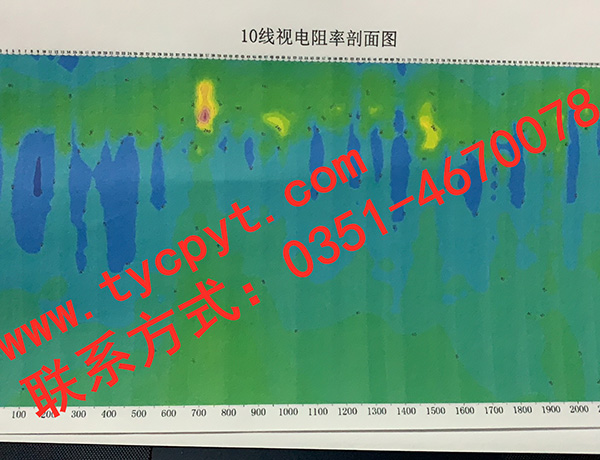

安博(中国)(Changping Engineering Co.,ltd)成立于 2005年7月,办公地址位于太原市杏花岭区迎春街58号金林雅苑6号楼二层注册资金 5000 万元。公司拥有工程勘察专业类(工程测量、岩土工程(勘察、物探测试监测检测、岩土工程设计))甲级资质:检验检测机构资质;工程质量检测机构资质:人工地基工程检测专项资质:地基基础工程专业承包壹级资质、环保工程专业承包贰级、特种工程(建筑物纠偏和平移)专业承包资质、特种工程(特种防雷)专业承包资质;施工劳务资质:地震安全性评价从业资格:工程勘察专业类(水文地质勘察)乙级资质:工程勘察工程钻探劳务资质;工程测绘乙级资质:地质灾害评估和治理工程勘查设计乙级资质、地质灾害治理工程施工乙级资质、地质灾害治理工程监理乙级资质:通用航空企业经营许可证。

0

成立20余载

0

11大服务项目

0

技术人员70余人

0

2000+工程项目

新闻中心

NEWS CENTER

技术规范 品质优良 不断改善 满足客户

Technical specifications, excellent quality, continuous improvement, to satisfy customers

技术雄厚

拥有一支理论水平高、实践经验丰富、技术力量雄厚、敢打硬仗的专业化新型队伍

业务范围广

业务范围涉及工民建、市政建设、工矿企业、交通、能源等领域

设备齐全

公司技术装备配套齐全, 均为国内科技领先的专业生产及施工设备

管理体系完善

公司坚持诚信经营、创造精品、用户满意,竭诚为社会提供优质服务的理念

联系我们

CONTACT US

电话:0351-4670078

手机:13333510360

微信:13333510360/tycpyt

邮箱:tycpyt@163.com

地址:山西省太原市杏花岭区迎春街 58 号金林雅苑 6 号楼二层

手机:13333510360

微信:13333510360/tycpyt

邮箱:tycpyt@163.com

地址:山西省太原市杏花岭区迎春街 58 号金林雅苑 6 号楼二层

©2021 安博(中国) 晋ICP备17010111号-1 技术支持 - 资海科技集团

©2021 安博(中国) 晋ICP备17010111号-1 技术支持 - 资海科技集团